A fantastic idea and the expertise to carry it out are all you need to start your own marketplace business. The moment a great concept is formed, a terrible where to acquire money or marketplace funding issue also starts. Eventually, the majority of would-be business owners lose up on their goals and go back to their 9–5 jobs.

Even if the startup’s initial funding allows for a successful launch, there are still considerable financial risks. According to statistics, only a little more than 50% of businesses survive until their fifth anniversary, and only 80% do so in their first year. The fact that they run out of money is one of the many reasons why about one-third of enterprises fail.

Unfortunately, none of these apply to your situation.

You shouldn’t let a limited budget prevent you from starting your successful marketplace firm. Financial difficulties shouldn’t hinder success. We have put together this advice to assist you in overcoming any potential economic challenges.

You may find the responses to the following queries right here,

- What methods of financing do marketplace entrepreneurs most frequently use?

- How can I ask my family and friends for financial assistance?

- Why are crowdfunding sites flawed?

- What is an incubator for business?

- What is the most prominent risk when working with an angel investor?

- Where are venture capitalists to be found?….and so much more.

In this chapter, you will find everything you need to know about raising money for a new online marketplace business.

What is B2B Marketplace Funding?

Marketplaces are online platforms that help streamline transactions by bringing buyers and sellers together. Because they provide countless chances, infinite inventories, and the utmost convenience, online markets, which are digital in nature, are rapidly gaining popularity.

Online markets like Amazon and Airbnb house some of the biggest businesses in the world. The ability to grow quickly requires outside resources therefore, success stories like this don’t often result from bootstrapping a company. Financing from the market is here.

Funding a business may be obtained in a variety of ways. To help you understand how to build your online marketplace financially, let’s break down the various forms of funding for the marketplace.

8 Ways to Raise Funds for Online Marketplace Business

Crowdfunding

Consider using crowdfunding platforms if you’re looking for a means to draw investors and market your product.

Crowdfunding is a method for obtaining money that relies on the group effort of local investors. Even if you’ve never heard of the phrase, you’ve definitely seen a number of examples of community fundraising online.

The idea of complete strangers sponsoring a business endeavor has become increasingly acceptable thanks to a variety of sites, including Kickstarter, Rockethub, and GoFundMe.

Additionally, business owners may conduct a campaign on these and other crowdfunding sites to generate money for markets. However, the majority of crowdfunding sites levy processing fees on contributions in addition to taking a cut of your revenue.

Furthermore, there are three types of crowdfunding:

- Reward crowdfunding

- Equity crowdfunding

- Debt crowdfunding

- Donation-based crowdfunding

Bootstrapping

The greatest place to start is with your money at first, especially if you simply have a vague idea.

There is still more excellent funding for the market. You also invest your cash and the startup’s operational profits, a strategy known as self-funding.

You don’t have to give investors the authority to make decisions because you will be using your own resources and finances to support your business. Your online marketplace company eventually belongs entirely to you.

Raising Money From Your Network

The initial investors might be attracted to your network if you have a high-potential idea that is supported by a presentation or a straightforward prototype.

The people you care about will put their money into you rather than your goods. And when you have no goods to sell, that is a great financing strategy.

You may get started by seeking assistance from your friends, family, teachers, and mentors. This is the second most typical source of fundraising in the US.

The number of investments attracted by this method can be restricted. However, it is a quick and easy step in the direction of tremendous accomplishments.

How can I raise money for my marketplace company from friends and family?

Never exaggerate the viability of your proposal;

Create a concise business strategy and specify the amount of funding you will require initially;

Describe your precise financial needs;

Make it formal by creating a partnership agreement that details the amount, payback schedule, and other details for each investor in your firm.

Martin Zwilling, the founder, and CEO of Startup Professionals, a business that provides support to startup entrepreneurs globally, advises doing it in plain language and with both logic and enthusiasm.

The local community can be involved if you focus on small local enterprises, for example, by developing an eCommerce platform for farmers or a delivery app that is in great demand during a pandemic worldwide.

Create a brief presentation and distribute it to any people who might be interested. Use social media or even launch a targeted advertising effort to catch the community’s attention.

A starting budget and the assurance that your market is in demand are two crucial things that this kind of partnership will give you.

The Business Line Of Credit

It is among the best methods for obtaining money from online markets. A business line of credit functions as a cross between a conventional bank loan and a company credit card.

In addition, a company line of credit is a great way to finance extra business costs when it comes to eCommerce.

In addition, using this kind of market financing gives you access to a certain quantity of money to help you achieve immediate business objectives. To apply for a business line of credit, you’ll need to provide the following essential information

- Business License

- 2 to 3 months’ worth of bank statements

- returns for taxes

- a bank account for a company

- Standard financial records, such as a P&L or cash flow statement

Additionally, you can make money from a pre-approved amount and set aside a particular amount to spend on the most pressing needs. It enables you to manage your business expenses without accruing excessive debt.

Venture Capital Funding

It examines equity-based funding strategies for online marketplaces and other enterprises. Venture capital financing is a common form of market financing that is very effective at making significant returns.

Additionally, venture capital firms fund initiatives and concepts they think will result in significant future profits.

Online marketplaces receive private equity funding from startups, with venture capitalists obtaining equity and the ability to influence the company’s business operations in exchange for their investments.

Angel Investors

After creating a marketplace MVP or a basic version of your online marketplace, you have the option of forging a partnership with angel investors.

An individual with a substantial net worth has the potential to become your business partner as an angel investor.

Angel investors are typically successful and well-known individuals who are interested in investing their funds into promising startups. In return for their investment, they acquire a share of the company.

Notably, Forbes publishes lists of prominent angel investors, which can serve as a valuable resource for identifying potential partners. Additionally, platforms such as LinkedIn, AngelList, and similar websites provide opportunities to connect with and meet potential angel investors.

Startups funded by angel investors

Heini Zachariassen, the CEO of Vivino marketplace, shared his experience of partnering with an angel investor during the early stages of marketplace development. He collaborated with Janus Friis, one of the co-founders of Skype, who had a passion for wine and was familiar with the team. As a result, Friis funded their angel round, providing crucial support for Vivino’s growth.

Zachariassen advises entrepreneurs to search for angel investors within their local community, with a specific focus on successful business owners who have already achieved success in the same industry.

However, he also cautions against angel investors trying to acquire excessive equity in the early stages, as it may be needed for future growth.

Another notable example of cooperation with an angel investor is Facebook’s experience.

In the summer of 2004, Peter Thiel, a venture capitalist, made a $500,000 angel investment in the company, acquiring a 10.2% share.

This investment played a significant role in the success and growth of Facebook, which has since become one of the most influential companies of our time.

Incubator And Accelerator Programs

If you have an innovative, revolutionary, or promising Marketplace idea, it is highly recommended to consider applying for a startup-accelerating program.

These programs are designed to support and nurture early-stage startups, providing them with various resources, mentorship, networking opportunities, and funding to accelerate their growth and success.

Participating in a startup accelerator can give your idea the necessary boost, help refine your business model, and increase your chances of success in the competitive startup ecosystem.

Entrepreneurs looking to acquire funding for their online marketplaces are increasingly turning to incubator and accelerator programs.

This funding method is not limited to the US, as startups worldwide are also benefiting from online programs. These programs provide startups with access to a wealth of resources, tools, and guidance from experienced professionals.

Incubator and accelerator programs work closely with venture capitalists to help startups through their early stages. They provide marketing, networking, infrastructure, and financial assistance.

Participating in an incubator or accelerator program can teach you how to build, scale, and manage your business effectively. A key benefit of participating in an incubator or accelerator program is the opportunity to meet with investors and pitch your business.

By creating a compelling pitch deck, you can persuade investors to provide funding for your marketplace startup. Startupbootcamp, 500Startups, and Y-Combinator are some of the most popular incubator programs.

Government Grants

Numerous countries show support for small businesses and are willing to invest in online marketplace startups, particularly those aligned with areas such as ecology, healthcare, and more.

Conducting comprehensive research is essential to identify the niche that your government is willing to invest in. It is crucial to pay attention to underserved areas and target specific locations accordingly.

Prepare your application by the government’s defined requirements and exercise patience as the review process may take several months.

An example of a government-funded startup is MyMoneyJar, an app startup based in Dublin. It successfully raised €700,000 through an Irish government program, showcasing the potential impact of government funding on startup success.

Stages Of Marketplace Funding

The amount of funding required to start a marketplace varies depending on the specific stage it is in.

A marketplace startup progresses through different stages, each necessitating different levels of funding. Here are three stages typically considered when seeking funding for a marketplace:

Problem/Solution Fit: Initial Marketplace Funding

When initially building a marketplace startup, it is crucial to identify the problem it aims to solve or the solution it offers.

Understanding why consumers would be willing to pay for the marketplace is essential. This process helps in defining the problem/solution fit and guides the development of the first “minimum viable product” (MVP).

During this early stage, seeking investors may not be the most effective approach as it can be challenging to secure funding without a clear MVP or proof of concept.

Instead, common funding sources for initial marketplace funding include bootstrapping, which involves using personal savings or resources or exploring small business grants that may be available from various sources.

These funding options provide a means to get the business off the ground and validate the marketplace concept before approaching investors for further funding.

Product/Market Fit: First Marketplace Funding Efforts

Once your online marketplace has launched its MVP, the next step is to gain traction and achieve product/market fit. This means ensuring that your marketplace product is meeting the demands of the market.

If it proves successful, it’s time to consider funding options to grow beyond the initial stage. To take your marketplace to the next level, you can pursue funding from venture capital firms or angel investors.

Alternatively, you can opt for a business loan if you prefer to retain full ownership. Typically, the first round of funding ranges from a few hundred thousand dollars.

Scaling: Later Marketplace Funding Efforts

To scale a marketplace successfully, substantial funding is required. Scaling involves activities such as expanding the team, increasing marketing budgets, securing office space, and potentially expanding internationally.

For this stage of growth, hosting a Series A, B, or C funding round (or beyond) becomes relevant. These rounds are typically conducted for high-growth startups and have the potential to raise millions of dollars in investments.

These funds provide the necessary resources to fuel the marketplace’s expansion and support its continued growth.

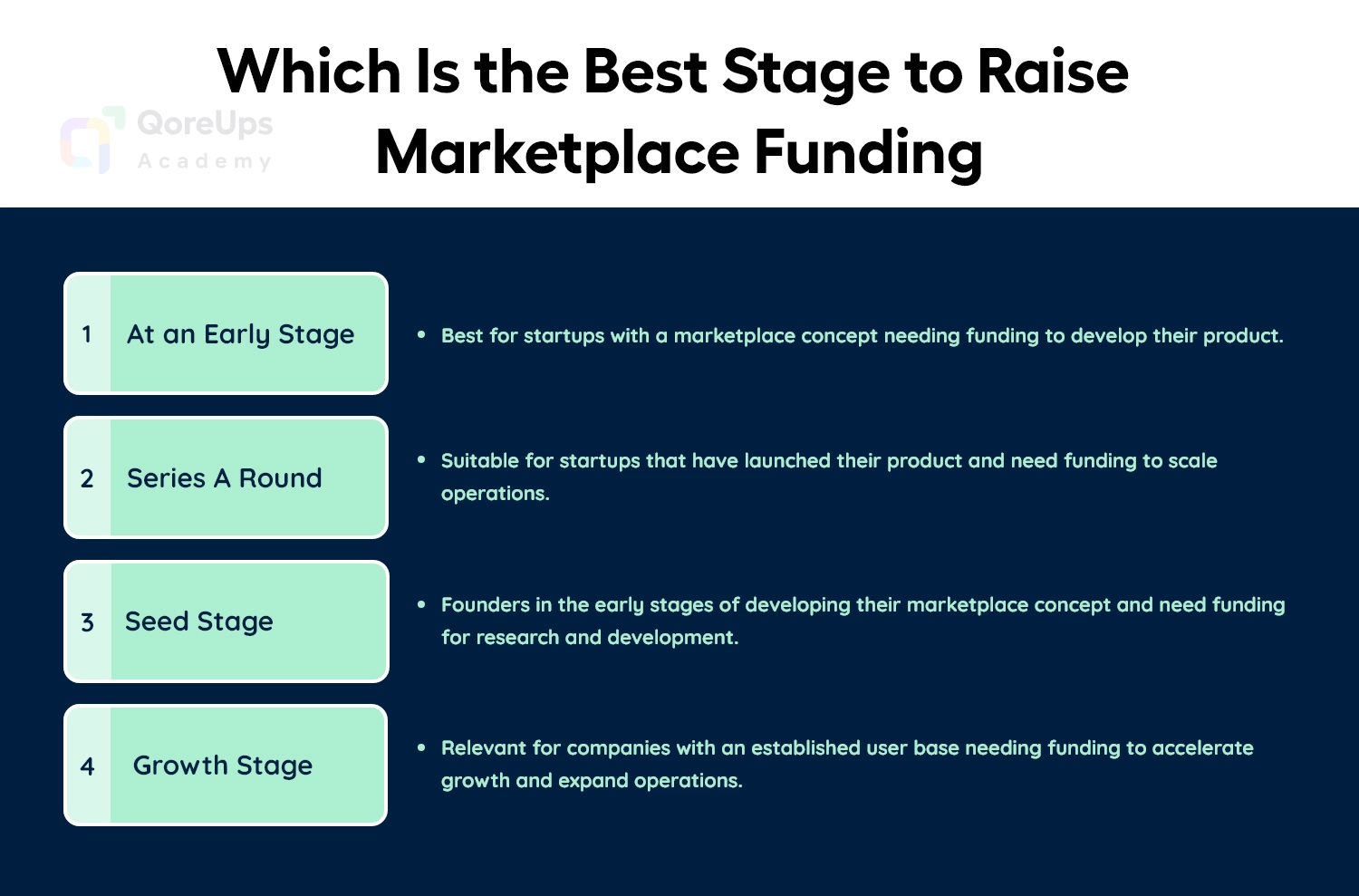

Which Is the Best Stage to Raise Marketplace Funding

At An Early Stage

At this stage, you have the opportunity to attract investment for MVP development and a marketing campaign. The focus is on proving the viability of your online marketplace business idea. This is typically done through pre-seed and seed rounds, where you aim to showcase the potential of your concept and attract early-stage investors.

Series A Round

In the Series A funding round, you have the opportunity to secure investments for the development and expansion of your comprehensive online marketplace business project. Your MVP serves as your business portfolio, demonstrating the functionality and value of your marketplace.

Pitching your MVP effectively becomes crucial in attracting marketplace funding. Additionally, it is important to show traction and prove the validity of your idea by showcasing early user adoption, revenue growth, or other key performance indicators.

Seed Stage

During the seed stage of your online marketplace business, you have a functional prototype prepared and ready to go. This stage focuses on validating the potential demand for your products or services.

You launch your prototype, actively engage with the market to understand its needs, and test your products or services with potential customers. This stage helps you gather feedback, refine your offerings, and demonstrate the market potential of your marketplace.

Growth Stage

Once you have developed a fully functional prototype and have gained initial traction, you can raise another round of marketplace funding to fuel the growth and expansion of your business.

At this stage, investors will expect a solid business plan and an estimated growth forecast that showcases the scalability and profitability of your marketplace.

This funding can be used to enhance your technology infrastructure, scale your operations, expand into new markets, or strengthen your marketing efforts.

Finally,

Understanding the stages of marketplace development and setting appropriate milestones is crucial in determining the optimal funding approach for your specific goals. The process of raising marketplace funding can indeed be complex and challenging, given the various funding options available for online marketplace platforms.

Each funding method has its own set of advantages and disadvantages, and choosing the right investment source requires careful analysis. Several factors, such as your business type and model, can influence your choice of investment option.

For example, if you are in the early stage of developing your marketplace and need funds to build your MVP and validate your concept, options like bootstrapping, small business grants, or angel investors may be suitable.

As your marketplace progresses and achieves product/market fit, you may consider seeking venture capital funding or participating in incubator or accelerator programs to fuel growth and expansion.

It’s essential to weigh the benefits and drawbacks of each funding method, consider the specific requirements and goals of your marketplace, and conduct thorough research to identify the investment option that aligns best with your business needs.

Ultimately, a well-informed decision based on careful analysis and understanding of your marketplace’s unique circumstances will help you select the most appropriate funding method and increase your chances of success in raising marketplace funding.